how are rsus taxed in the uk

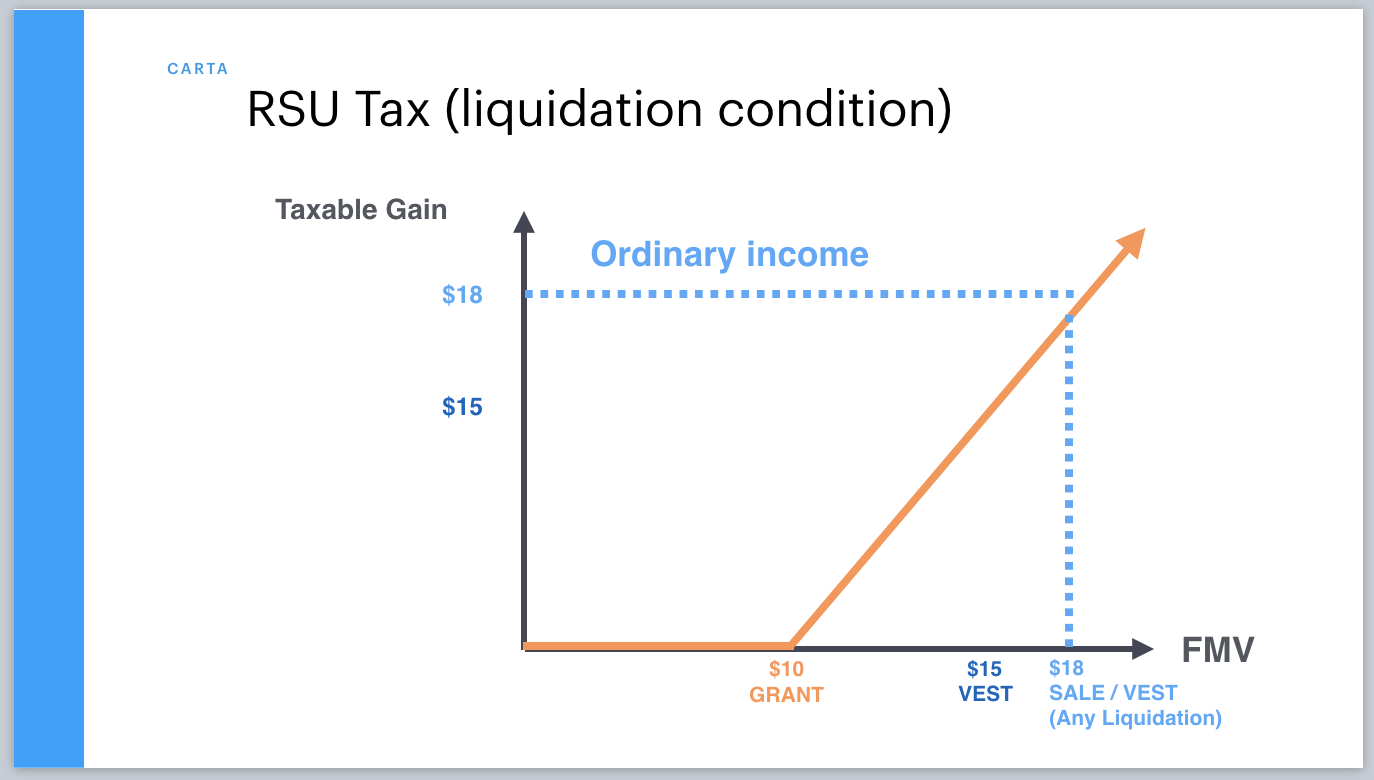

Taxes at RSU Vesting When You Take Ownership of Stock Grants. Long-term capital gains tax on gain if held for 1 year past vesting.

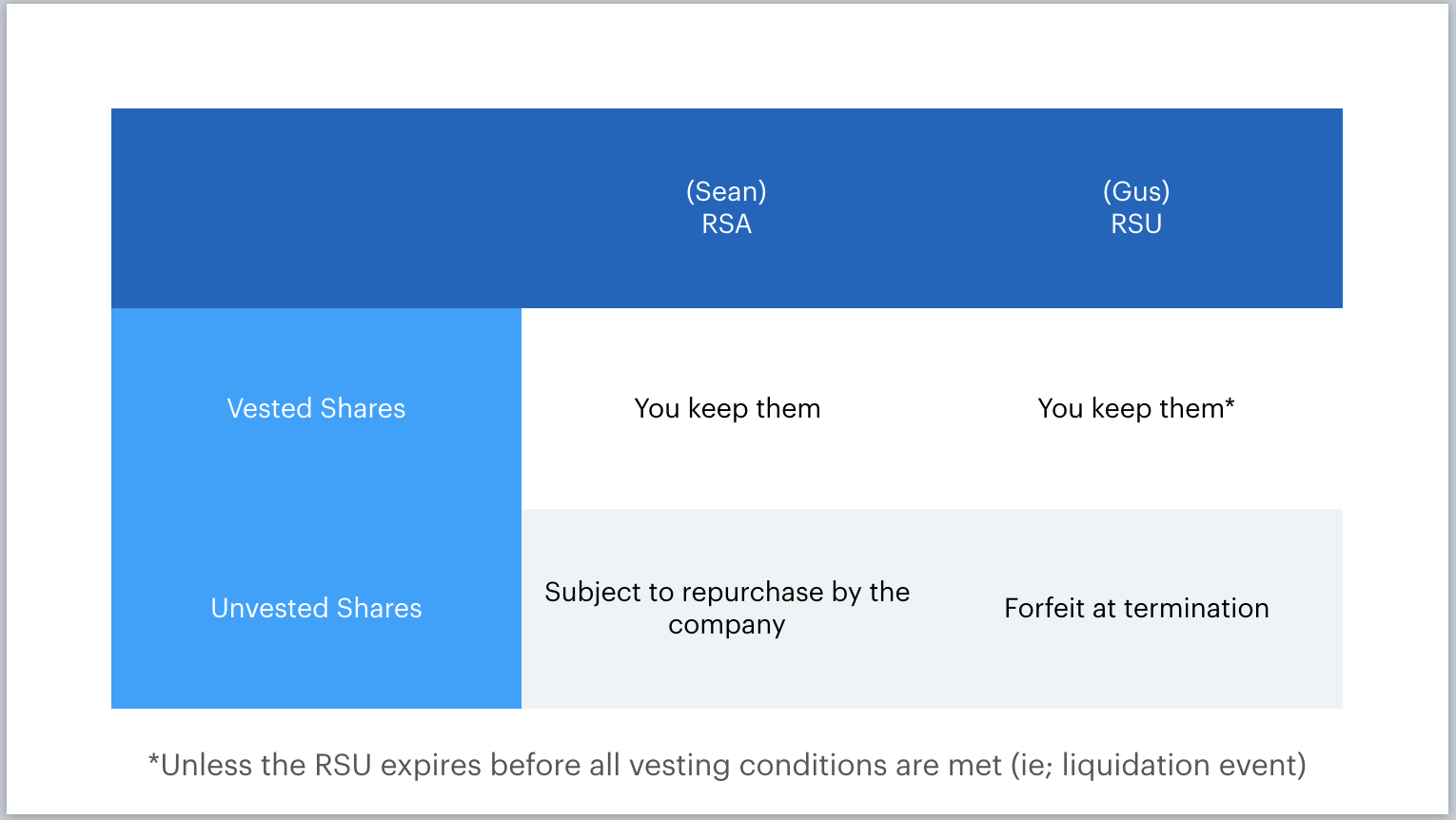

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

If the RSUs take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers National Insurance.

. But first a brief review on restricted stock unit taxation. Essentially the RSU is then treated as a stock option for UK income tax and NIcs purposes and the tax charge arises under the employment-related securities provisions. RSU on self assessment.

Income tax 40 of Remaining 8620. You will pay income tax and national insurance on the value of RSUs vested. How are RSUs Taxed.

The UK tax treatment for RSUs is similar to how your salary is taxed. The tax payment is usually the last step before the shares eg. On their UK payslip last one of the year it shows their final salary and the total RSU and RSU taxes as income then the total RSU as dedcuted.

Employers have the discretion to either pay this themself. Where the RSU is taxed as a securities option the CGT acquisition cost is then just what was paid to acquire the shares and any amount taxed in the UK as a securities option gain. RSU Value 25000.

Less National Insurance 2-345. Deducting employers NIC 138 3450. If you already earn in excess of this and the RSUs take you over 150000 you will pay 45 income tax plus the employers National Insurance.

RSUs generate taxes at a couple of different milestones. Total Tax and NIC 34508620500043117500. Unlike a salary that is subject to taxes RSUs in the UK are tax-free.

You will receive the net amount after withholding taxes. I have a client who worked abroad and moved to the the UK and had their RSUs vested when they moved to the UK. Restricted Stock in the UK which is best.

RSUs are free of tax from the start. Essentially the RSU is then treated as a stock option for UK income tax and NIcs purposes and the tax charge arises under the employment-related securities provisions. You may also need to pay for employers national insurance.

Once when you take ownership of the shares usually when they vest and again in another way when you actually sell the shares. So RSUs which do confer upon the recipient a right to acquire securities - see ERSM110500 will be taxed under Chapter 5. The gain from the sale of shares is subject to tax as capital income at 30 percent up to EUR30000 and 34 percent for the exceeding part.

A RSUs isnt taxable when it is granted in any case. In reality the difference is the RSU Taxes left. The loss from the sale of shares can be carried forward up to 5 years.

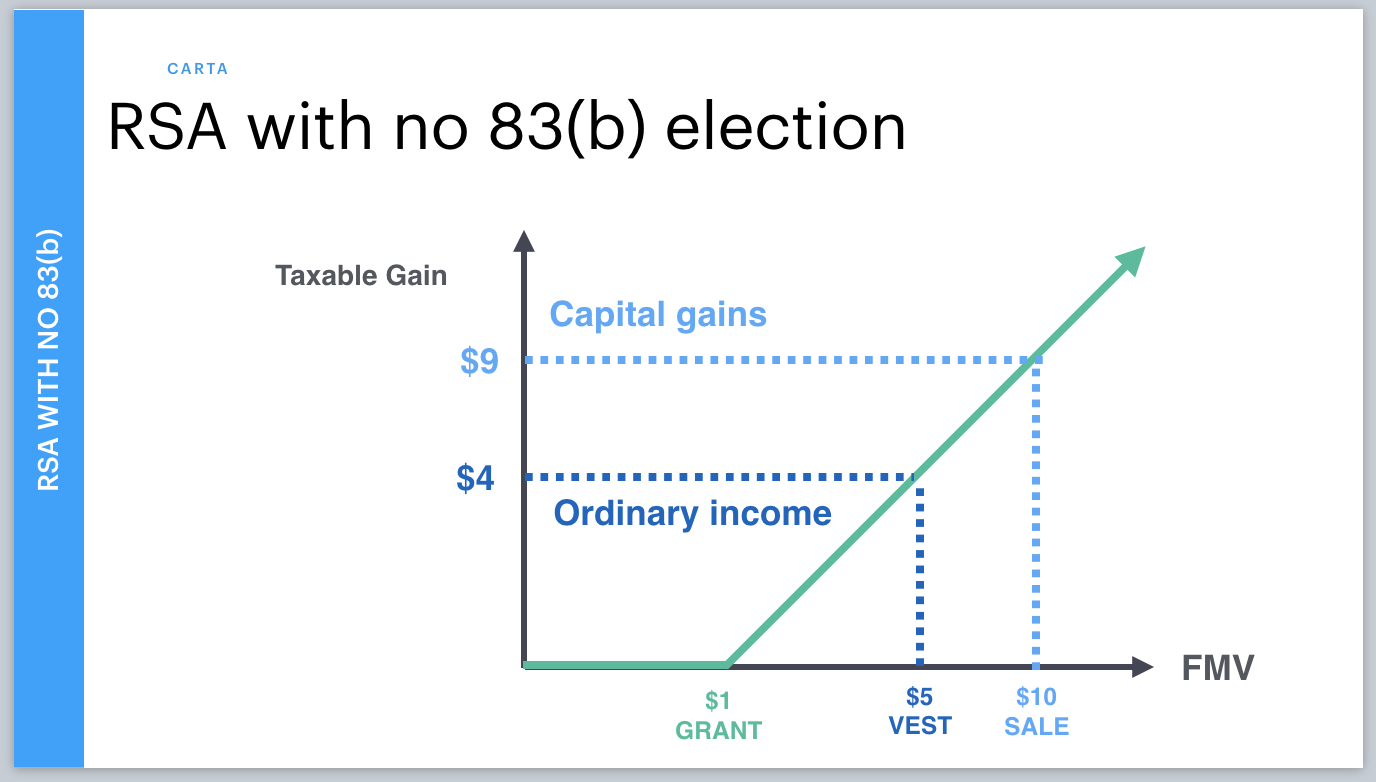

Short-term capital gains tax ordinary income tax rates otherwise this includes immediate sale caution When you receive your shares you are taxed on their value at that time. Net RSU Value Before Employer Income Tax NI. Restricted stock and RSUs are taxed upon delivery and subject to progressive income tax up to 56 percent.

For tax purposes RSUs are not taxable. When your RSUs vest you will pay income tax and employee national insurance. You only pay tax on RSUs when they vest.

The UK tax treatment for RSUs is similar to how your salary is taxed. You only pay tax on RSUs when they vest. The RSUs are subject to NI and income tax at your marginal rate on their value at the time they vestYou can either choose to pay the tax yourself and receive all the sharesbut most people will opt to have shares deducted to pay for these deductionsSo if you are a higher rate tax payer you will be due to pay 42 tax and NI which would mean your 50 shares would.

The taxable amount will be the fair market value of the shares issued to you at vesting. Extra tax of 4310 due to loss of personal allowance as income above 100000 Employee NIC 2 431. Residual Value After All Tax.

However HMRC is generally prepared to reduce the UK tax liability to reflect the relative number of workdays that you have spent in the UK and the other country between grant and vesting of the option and the subsequent grant and vesting of the restricted stock units except where there. Heres the tax summary for RSUs. 70 Tax and NIC Paid.

Less 60 Income Tax 40 Higher Rate Tax plus Loss of Personal Allowance-10344. How are RSUs taxed in the UK. The difference between this and.

I was wondering how RSUs are taxed in the UK I have a certain amount of RSUs when do these become stock and what is taxed as income and what is capital gainsTC200k. The United Kingdom pays tax only on RSUs when they vest. This post is not and cannot be considered as legal or tax advice proper legal and tax advice should be sought in respect of the content.

Employee shares is taxed in the UK as general earnings they are normally treated as acquired at their market value. Ordinary tax on current share value. Top of page RSUs that provide cash on vesting.

Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock. As a result of withholding taxes you shall receive the net amount. Shares tax will be paid in advance.

How Are Rsus Taxed In The Uk. RSU vested in 202122 tax year. Employee total salary before.

Less Employer National Insurance 138-2760. In all cases there is no tax to pay when RSUs are granted. In most circumstances tax will be paid before you receive the shares ie.

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Capital Gains Tax In The Netherlands

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Scrolling By Max Kalik Web App Design App Interface Reading Process

Which Is Better Stock Options Or Rsus All You Need To Know Stock Options Staging Companies Options

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta